Table of contents

Any insurance company must innovate and rely on an online presence to maximize its efficacy. Without digitalizing services, businesses will struggle to attract customers: every year, the number of people who prefer online shopping to offline increases significantly.

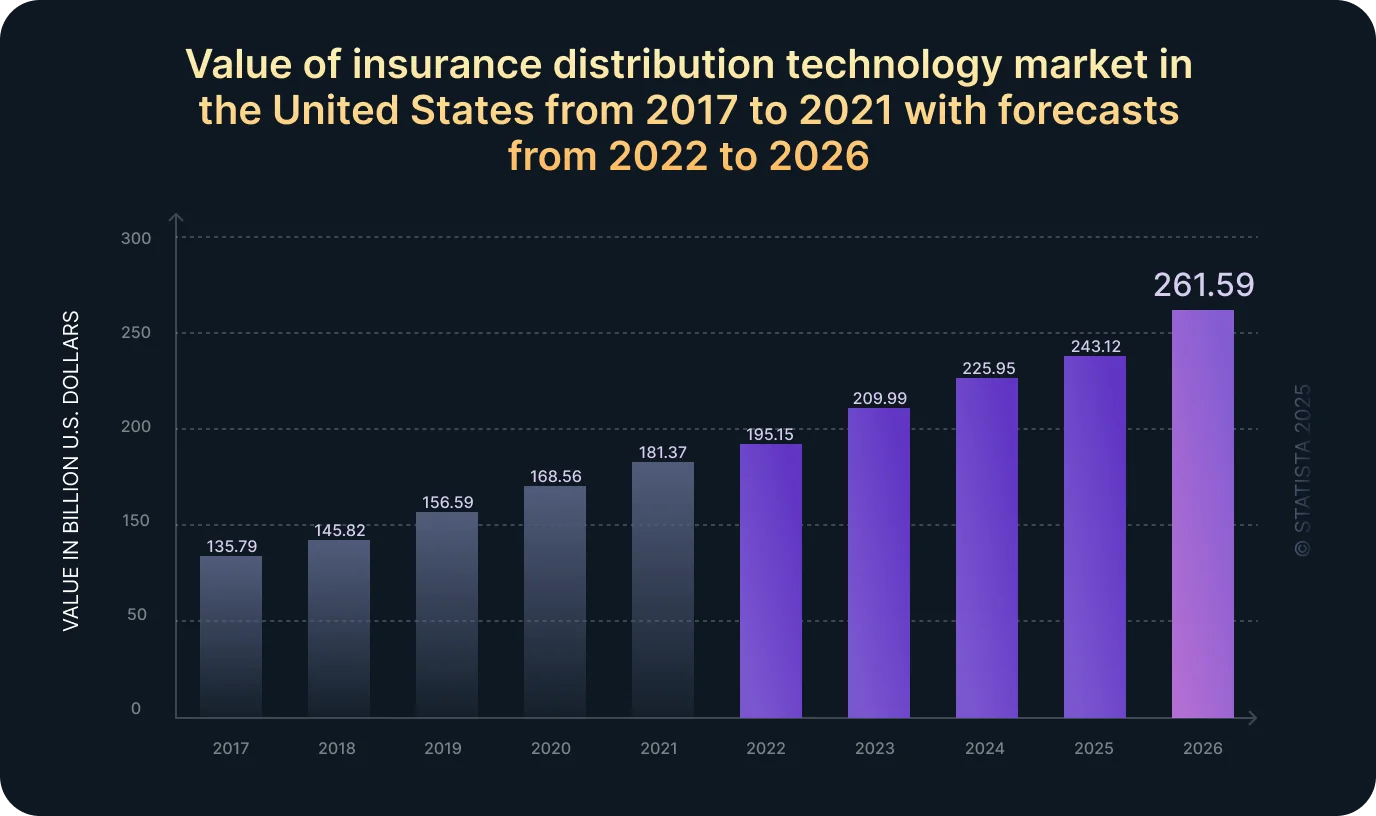

According to Eurostat, insurance policies are at the top of online purchases by Internet users. Additionally, as per Statista, the U.S. insurtech market is expected to continue growing until 2026, with the market size predicted to reach 261.6 billion U.S. dollars.

These statistics indicate that insurtech is needed today. People are excited to buy insurance services online. Therefore, to define your insurance company as modern and profitable, you must provide customers with technologies: an e-platform, a mobile app, a chatbot, and a cloud database.

So, how can you make your insurance company more modern and tech? In this blog, our Head of Business Operations, Nataliia Shapran, will explore the challenges of digital transformation in insurance, highlight successful insurtech startups, and outline key features of a competitive insurance platform.

What Are the Challenges of Boosting Insurtech?

Applying our experience in insurtech, we have listed the top challenges while innovating the insurance business. Moreover, our developers have proposed solutions to address each of these challenges.

Complex Insurance Buying: The complicated process for insurance buyers requires extensive steps to find and secure a policy.

Solution: The insurance system must automate the entire process to ensure that customers can purchase the policy with just a few clicks and receive the documents via email.

Data Deficiency in Personalized Quotes: The inability to create personalized proposals due to the absence of data about the insurees.

Solution: Establish connections to various databases to assess the insuree in real-time, calculate premiums, and create a personalized proposal immediately. End-users only need to enter minimal information on the platform, while the system will pull additional data from specialized databases using third-party APIs.

Embedding Insurance Products into Workflow: This issue often requires long development cycles and specialized technical expertise. A good example is adding the ability to get travel insurance during the final step of booking a flight or offering rental coverage during car rental checkouts. These processes are typically embedded within the primary business flow.

Solution: the addressing of this challenge is possible by delivering the ability to configure customizable embedded insurance widgets as part of insurance product configuration. This approach enables digital quote-to-bind capabilities across any channel. Moreover, businesses can now offer a seamless customer experience, making integration significantly easier.

Subscription Management Hurdles: Preventing clients face unexpected costs or gaps in coverage while managing monthly subscriptions.

Solution: Delivering an efficient monthly insurance plan subscription system ensures no client overpays for their policy.

Risk Assessment: Ensuring accurate risk assessment across diverse regions while maintaining data integrity and confidentiality

Solution: Integrating a postal code database enables location-based risk scoring, while regional settings ensure personalized insurance options for global clients.

You should contact us if you have more specific questions about project ideas. Additionally, you can read more about insurance and other projects in our case study.

Which Insurtech Startups are Successful?

One of the best ways to strengthen your insurtech company is to analyze the groundbreaking insurtech startups that have achieved in providing advanced technologies and learn from their experience. Here are four standout companies leading the way:

- Next Insurance: Launched in 2016, Next Insurance caters to small businesses by offering tailored insurance policies across various industries. Next Insurance harnesses ML and big data to provide ultra-personalized policies. Moreover, using AI, it processes applications in just 10 minutes, significantly reducing the time businesses take to obtain coverage.

- Oscar Health: Founded in 2012, Oscar Health offers health insurance plans for individuals, families, and employers. The company’s insurers can easily access plan details, in-network care, 24/7 virtual consultations, messaging support, and bill payment features. Oscar Health utilizes technology to offer a seamless digital experience, including telemedicine services and AI-driven care navigation.

- Lemonade: Launched in 2015, Lemonade offers renters’ insurance, homeowners’ insurance, car insurance, pet insurance, and term life insurance through a user-friendly digital platform. A key feature of this company is a unique policy management experience, which includes AI-powered quoting and claims tools that service directly in the customer’s mobile app.

- Root Insurance: Established in 2015, Root Insurance provides personalized car insurance rates based on individual driving behavior. By leveraging telematics and data from the smartphone’s sensors, Root offers a car insurance quote based on how you drive.

How to Enhance Your Insurtech Company?

As noted above, every profitable insurtech business has integration with cutting-edge technology, mostly even several. Therefore, we prepared a list of must-have technological features for insurtech:

1. Digital Platform

Primarily, in insurtech, your company must own an e-platform that provides services and policies on a user-friendly interface. The benefits of creating an insurance platform are countless: increase in customer outreach, automation of service signup, optimization of insurance agents’ performance, analytics and personalization of quotes, a convenient way for the insuree to manage their portfolios from the devices, purchase policies, monitor policy performance, and more.

2. Mobile and Web App

The next step is to develop mobile and web applications. These applications enable insurers to easily manage their claims, access insurance information, update policies, and receive real-time assistance from any device anywhere. By integrating real-time data tracking tools, these apps can also offer dynamic pricing models and proactive risk prevention tips based on user behavior.

3. Cloud Technologies

In addition to developing software solutions for your insurance business, it is essential to consider cloud technologies. Mainly because they enable secure decentralized data storage and high-speed processing while ensuring scalability and cost efficiency. Also, you can integrate parametric insurance models and facilitate seamless API connections with third-party data sources using cloud services.

4. Data analytics and machine learning

Data analysis is an integral part of insurance practices. However, processing the vast amounts of insurance information demands much effort. Fortunately, we live in a time when machine learning and AI can perform analytics for you. Whether you want to automate repetitive tasks, predict behavior and risks, or optimize claims processing and underwriting, machine learning algorithms can do that for you.

5. AI-powered chatbots

Suppose you want to enhance customer experience, reduce the workload of the support insurers, gather insights from insurers, and implement new technology that is fully discovered and won’t cost much. In that case, an AI-powered virtual assistant is your best choice. It can handle policy inquiries, assist with claims processing, and provide personalized recommendations by analyzing real-time policyholders’ data.

Bottom Line: Why Does an Insurance Agency Need to Utilize Advanced Technologies Today?

To remain competitive, insurance agencies must integrate advanced technologies. As the preference for digital insurance solutions grows, adopting innovations such as AI-driven platforms, cloud computing, and mobile apps is crucial. These technologies will definitely align with modern consumer expectations, driving profitability, reducing costs, and attracting customers.

If you are interested in this topic, check out more of our articles about product development click here.

Set up a free consultation to see how you can digitally transform your business! Our experts will conduct a detailed analysis of your business and ideas, then provide a proposal on how to achieve the best results with your project.